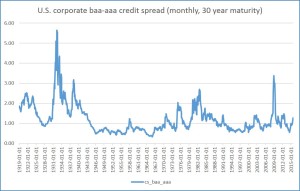

The graph shows the monthly U.S. corporate credit spread of Baa-rated bonds minus AAA-rated bonds. The bond yields are calculated as Moody’s seasoned corporate bond yields with maturities as close as possible to 30 years. Meaning? When the likelihood of default increases, the bond yield increases. Baa firms are more likely to default than AAA firms. When good economic conditions are expected, investors expect both Baa and AAA firms not to default, and thus the credit spread is small. When poor economic conditions are expected, the likelihood of default of all firms increases, more so for Baa firms. As such, investors demand greater return (yield) and so we see the credit spread increase. A high spread generally indicates(expected) poor economic conditions.

A data file is here.